“Everyone is looking for business, not integrity.” So says one of our sources within the organic cotton sector – an industry dominated by large platforms, and a place where some experts are afraid to speak out publicly for fear of losing their livelihoods.

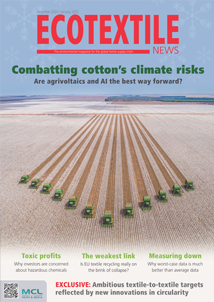

Integrity in the Indian organic cotton sector has been a concern for 14 years. We've covered it in depth and were about to do so again before being scooped by a few days by the New York Times in an article that once again stirred the hornet's nest.

Rather than repeating the concerns of the NYT article, this in-depth investigation - which appears in the latest issue of our Ecotextile News magazine - asks who’s to blame for the ongoing problems with organic cotton fraud in the supply chain, and how these problems might be solved? And why some organisations have been dragging their heels for so long?

Recently, much of the blame has been pinned on actors and certification bodies (CBs) operating in India. However, does some responsibility lie with organic cotton standard bodies and other promoters who may be tempted to prioritise revenue over tackling fraud?

No doubt it’s more complex than that but given long-standing doubts about the provenance of Indian organic cotton, now’s the time to ask some difficult, legitimate questions about why this is still an issue.

Background

Back in the late 2000’s, I was in India with a colleague after hearing many reports of fraudulently labelled organic cotton, trying to find out what was going on by meeting with certifiers, researchers, producers, project managers, spinners and farmers.

Certifiers were under pressure to cut costs and corners. Demand was growing fast. Field agents were young and inexperienced. GMO cotton was everywhere. Brands were asking for premiums to be cut. No one wanted to say no to anyone.

Cut to 2022, and it’s a case of “plus ça change”.

One of the main problems was that many apparel brands did not understand that organic cotton required a five-to-seven-year agricultural transition period to educate and train farmers, not just a two-to-three-year transition to certification.

This was reported. Nothing much was done. Some promises were made, but systems were inadequate and error prone. Since then, reported organic cotton production and market numbers have looked increasingly dubious – as we’ve previously pointed out – even though based on self-reporting, organic cotton production appeared to soar as did sales. But the reality was increasingly out of whack. Meanwhile, GM cotton in India reached 95 per cent of total cotton production in the country.

Sources within the certification sector, NGOs and others now allege that some promoting bodies knew the data was incorrect. We also have reports that systems that could have reduced fraud – and error – were offered to the industry as far back as 2014, but rejected.

"Fourteen years later, no one knows how much organic cotton is actually grown, processed and certified at the farm in the supply chain,” Crispin Argento founder of the Sourcery, and ex-director of the Organic Cotton Accelerator (OCA), tells us.

“Based on the limited available data available, estimates are that as much as two-thirds of the certified organic cotton sold is likely conventional cotton sold as organic."

So what's so wrong?

The International Standards Organisations (ISO) defines certification as “the provision by an independent body of written assurance (a certificate) that the product, service or system in question meets specific requirements”1. Certification bodies (CBs) are accredited by a nominally independent body. In organic, that’s IOAS (formerly, the International Organic Accreditation Service).

Audits are annual and pre-booked, albeit there also might be occasional random visits.

In organic cotton, there are farming standards, standards for movement through the supply chain, for processing, and so on. Most supply chains have multiple CBs at different stages, each with different traceability systems. The system is fragmented. There is no end-to-end tracing but instead movement and tracking of paper certificates (maybe scanned) between different supply chain elements.

Paper is fingered by most respondents as the problem. We’re not tracking product or process. There is no central repository of certificates (well, there is, IFOAM's BioC, but we’re not sure anyone in cotton uses it and BioC did not respond to our request for an interview). No one shares their data to allow others to check what goes in, and what comes out.

Data quality

As such, the system is ripe for exploitation, on top of multiple possibilities for data entry errors which no one checks either.

This is despite both Textile Exchange (TE) and Global Organic Textile Standard (GOTS) saying they are actively working on fraud prevention. Holger Stripf, head of marketing at GOTS, told us: “Seed cotton entering the GOTS supply chain is tested for the presence of genetically modified organisms.”

CBs were also required to test for pesticide residues based on risk assessment. Stripf also noted that GOTS required CBs to perform “a plausibility check in the form of volume reconciliation”. However, our own CB sources say they do not have insight into the actual or expected total volumes of organic cotton, so this is impossible.

Meanwhile TE told us: “Our standard requires certification bodies to record and verify the certified volume input and output for each transaction, considering acceptable production losses.

“We are also currently developing our Trackit traceability program for added oversight in the reconciliation of volume across certified supply chains.”

However, our sources report that no one is comparing or aggregating at present. Also, will Trackit be proprietary and compatible with other systems?

Who polices the industry?

The answer is no one, or rather the industry supposedly polices itself. The International Federation of Organic Agriculture Movement (IFOAM) is not as involved in cotton as it is in other sectors so no one body regulates or polices behaviour. No one is penalised for wrongdoing, except perhaps cotton farmers.

GOTS has done better on improving fraud protection, but it covers only one part of the industry – textile processing.

In India, the Agricultural & Processed Food Products Export Development Authority (APEDA) was tasked to improve the sector and put in place Tracenet to manage numbers. It made progress. We were told in 2018 that it was improving and cracking down on errors and fraud – but reports, then and now, say a major problem is that the Indian standard and Tracenet stop at the cotton gin.

We also understand from those in the know that the Indian Sustainable Organic Textiles (ISOT) standard was dropped in 2014 at the insistence of the voluntary standards which claimed to be developing their own solutions. It’s claimed they rejected Check Organic because “we have our own system”, according to Check Organic’s Gerald Hermann. The traceability chain was broken some more.

One industry source, who wanted to remain anonymous, told us: “Many bodies actually avoid the Indian standard system as it could ensure full traceability, making fraud detection easier.”

Full traceability, however, would also reduce the reported size of organic cotton markets and subsequent earnings for some in the sector.

Recently, Hindu Business Line2 reported on claims of a “cotton mafia” by an Indian MP, Gajendra Patel, who accused them of exploiting farmers, adding that “fake” organic cotton groups were debasing the efforts of genuine organic farmers. Patel has called for an inquiry and challenges the relevance of APEDA (in June 2021 the USDA terminated its organic recognition agreement with APEDA over fraud concerns).

Accreditation

So perhaps the fraud problem lies with the accreditation of CBs?

IOAS were asked to comment on recent suspensions of CBs but executive director David Crucefix told us: “We value our independence and integrity above all else. Therefore we prefer not to make any comment on any specific cases nor on the circumstances surrounding such cases. I suggest you speak with the relevant scheme owners, APEDA, GOTS and Textile Exchange.”

So we did.

GOTS said it had “developed a separate accreditation system based on International Standards Organisation (ISO) ISO/IEC Guides 17011 and 17065. The fact that ONECERT’s GOTS accreditation was withdrawn is proof that this control system works”.

Pe-Jae Brooks, of TE, added: “It’s OneCert’s accreditation body IOAS that has found the non-conformities with the Textile Exchange’s assurance requirements, the specifics of which we are not at liberty to share at this time.”

Note the subtle difference from GOTS managing director Rahul Bhajekar who – two days earlier – told us: “The exact reasons for the withdrawal were not disclosed to us since this process remains independent of the standards setting body, but we were told that there were lapses in the systems of the CB, and they had non-conformities that could not be closed by the CB.”

These statements followed a release from TE, in January, about OneCert's suspension, saying “these circumstances reflect the integrity and consistency of our assurance system”.

The subsequent New York Times article blew out of the water claims that the system was working.

What now?

Organic sector veteran Gerald Hermann, current director at Organic Services GmbH and one of the founders of the ‘Check Organic’ traceability system, describes the situation as “the well-known story of collective failure and commodity fraud”.

In other words, some organisations have been raising revenues while at the same time not using the collected data to improve integrity So why do organisations not publish production data and why are Indian textile standards rejected?

Stripf says GOTS accepts fibres from “all standards under the IFOAM family of standards and NPOP is one of them”, but he did not comment on the Indian standard for organic textiles (ISOT).

It’s clear there were some recent tensions between TE and GOTS, after a GOTS statement noted: “Regarding the alleged quote made by Ms. Pepper (CEO of Textile Exchange): GOTS has not received any evidence of fraud, whether from Textile Exchange or other partners, since uncovering fraud in India in 2020 through its own research ... we are eager to see such evidence, as GOTS consistently acts against such proof and imposes strict sanctions such as certification bans.”

Sources at CBs told us they felt they were being ‘scapegoated’ for system-wide failures and to ensure that profits from standards were not impacted. But if there has been a mismatch between production and consumption since 2008, then clearly the system is not working. Good organic cotton farmers are the ones to lose out.

India is not the problem, the system is

For years India has been blamed for the problem when it comes to organic cotton fraud, but we need to look further to get to the root of the problem. That means the market. The pressure for growth. And where the bulk of the revenues from Indian organic cotton go – which is mostly outside the country.

The problem is especially complex, but at last there are attempts to reverse the damage.

Stripf at GOTS says, “GOTS is currently developing a centralised database which will track the origin of organic materials and will cover the entire GOTS chain of custody”. This will be funded by grants, not clients, to ensure independence, he said, adding: “Once operational, among other benefits, we will have centralised access to volumes (e.g. of lint cotton) that go through GOTS in the near future.”

Yet our sources contend that, with their India-based staff, standard setters already know the reality, but pass these 'bugs' in the system on to certification bodies, even as “certified units are swelling faster than organic cotton farmers.”

TE told us: “for the Organic Cotton Market Report, we collect data from producers, gins, certification bodies, regulatory bodies and estimate the global organic cotton production volume based on the data collected.

“This data is triangulated but not verified as it is beyond our scope to audit the farm. Additionally, this volume may or may not end up in our certified supply chain (i.e., certified to the Organic Content Standard).

“The implementation of our Trackit traceability program will also aggregate transactional information from certification, which will provide volume data of certified material moving through the chain.”

Is an estimate good enough when fraud is involved?

Additionally, CBs are listed as a reliable source even when recent scandals illustrate how much fake organic cotton there is. And while the Trackit system does sound like an improvement, it does not negate the need for an open-source database.

A senior Indian cotton expert, who helped pioneer work in both organic and Better Cotton, points to design failures as well as procedural and monitoring failures.

“When problems first emerged with contamination and testing, growth slowed,” he says, adding that this was some time around 2010/11. “But then, people started getting around the system once more.”

“Only 15 per cent of practices and tools from research make it to farmers in the cotton sector because extension is so poor,” says our expert who adds that the current system is designed for box ticking, not supporting producers, while farmer training is done by poorly paid and low skilled people.

He also says that, as most farmers do not have bank accounts, there is no proof of what cotton goes where. Bank payments for organic could be tracked “but with paper you can write what you like”.

Farmers meanwhile receive no premiums and low prices because aggregators buy 64 per cent of cotton from smallholders, according to a 2019 report from IDH and Technoserve3. This reduces farmers’ incomes even further.

Another recent report in Hindu Business Line shows that violations identified by APEDA include farmers not being aware they were certified organic as well as conventional cotton being passed off as organic (overly high yields were also reported)4. An organic cotton pioneer points to the low numbers of inspections (10 per cent within a farm group) and to insufficient farmer training. Also, the number of CBs means competition for business drives down bids for work and so reduces quality. But no one wants to admit to certification failures as this would affect future business. It’s almost as if the system is designed to fail.

It's not just India that’s affected either. James Vreeland of Peru Naturtex told us that while cotton production in Peru has declined over time, overtaken by other cash crops, the country has largely become an importer. Much of this, he says, is “supposedly organic cotton yarn from India”. He suggests this is known to authorities and that urgent action is needed to save “commercial cotton cultivation in Peru”.

A mish-mash of systems

We have a fragmented cotton traceability and certification system, data errors, no transparency, no data sharing, a refusal to take responsibility by some major players, and a blame game against certifiers, with lots of revenue and prestige at stake.

When we asked Bart Vollaard, executive director of OCA, why it had taken so long to find solutions he said: “A degree of fragmentation has made change within the certification system a slow and challenging process, but the industry has also taken a long time to realise it needs to look beyond certification and invest in the base of the supply chain.

“It is still only now realising that it needs to make organic work for farmers. This was exactly the background against which the Organic Cotton Accelerator was founded back in 2016.”

Against this backdrop, the organic sector has tried to look perfect for years. Pretending only a little tinkering was needed. Instead, we have a perfect storm: poor transparency plus inadequate systems mean that we now have a Swiss cheese certification system, with as many holes as substance.

And there are currently no incentives to improve. CBs have no legal requirement to act on problems in the system outside their own clients – and doing so would impose costs for which there would be no reward and a likely suspension.

Argento says the solution is the direct to grower model, which includes information from brands, suppliers and farmers, which he claims is a vast improvement. “Using self-reported information from brands, suppliers and farm organisations, the discrepancy between certified volumes purchased versus those reported by Textile Exchange was alarming,” he claimed, adding, “Although there has been improvement in the data in recent years, getting publicly available verified data has proven very difficult because many private organisations, particularly the standard holders and their certification bodies, are keen to protect their reputations and financial interests.

“Organic cotton certification alone is estimated to generate well over US$200 million in annual revenue for these organisations, which amounts to supply chain premium of over US$0.80 per kilogram using Textile Exchange production data from its OCMR. As made clear by these organisations, this chain-of-custody system does not include certification at the farm or cover the costs of growing cotton fibre organically.”

No one asks how much money is being lost because of organic cotton's poor reputation around fraud.

Stripf told us: “This is an important question for member-based organisations. But not for GOTS. We are an independent non-profit organisation. The commercial aspects of the textile industry, especially of brands and retailers, is irrelevant to us.

“GOTS finances itself through annual fees per certified facility. Each of the approximately 12,000 certified facilities worldwide, regardless of size, pays the same amount of €150 per year.”

TE responded: “The real loss here is money that has been paid to unscrupulous people engaging in fraudulent activity. These actions undermine the work of thousands of farmers, manufacturers, brands, and other groups that are truly investing in best practices.”

TE did not tell us how much they spent on fraud prevention, simply stating: “We dedicate a substantial amount of our assurance budget to improving integrity.” Here they cite investing in regional ambassadors, data collection, an integrity task force team and the Trackit programme.

Denial

The organic cotton sector as a whole “continues to be in a state of struggle and denial for over a decade without showing willingness to improve”, says Arun Ambatipudi of the Chetna Organic umbrella programme which works with small and marginal Indian cotton farmers in Maharashtra, Odisha and Andhra Pradesh.

“The problem”, another certification source says, is system wide, including an “ignorance by standards setters and their promoters of the realities in the field, with standards written by ‘western bureaucrats’ in air-conditioned offices”.

Our Indian sources reveal that although quality assurance teams visit fields, as do staff from Western promoters and accreditation bodies, they fail to notice much. The source says this should be investigated while GOTS and TE should publish their data, but alleges “they know if complete and proper traceability will be established, they will lose business”.

Problems in regulation and governance

It all comes back to a certification system built on paper. Audits are mainly a paper trail, and field visits are planned in advance. These take priority over building farmer knowledge, while cost pressures on CBs mean they work as quickly as possible, may lack qualified staff, while competition means no one wants to risk going public with failure.

The problem is not individual CBs but the system design and a failure since 2008 to implement mass balance reconciliation.

Binay Kumar Choudhury and Robert Demianew, from the global certifier Control Union, told us there were many points of pressure in the system, with certification split between multiple bodies and standards. There are 32 farm level CBs with Control Union certifying perhaps only five to seven per cent of the total organic cotton farming.

From the gin, where the GOTS and TE standards start, upwards there are still 18 CBs as well as testing labs. GOTS’ approved labs depend on transaction certificates from other labs. This fragmented landscape of multiple bodies certifying only parts of the chain is a major opening for fraud and error.

“CBs are supposed to perform risk analyses based on transaction certificates,” Binay and Robert say, “but there are too many breaks in traceability.” This suggests there should be an open data registry to allow for full traceability.

But most sources agree whether all products are organic is still questionable.

Industry inaction?

Our source claims that GOTS, IOAS and TE regularly collect data from ginning mills, and also claims they have complete data on how much cotton comes into their own systems, but have “failed to take action on what they knew about the imbalance between the amount of organic cotton and the amount of organic textiles being made”.

But this allegation has been denied. In response to the New York Times article, TE said: “Organic cotton is a complex, multi-layered subject, and one that can quickly lose critical nuance when condensed into a single article. Without the right context, the piece risks undermining the importance of organic agriculture, while skipping over the solutions.”

But we’ve been here before. This is a problem.

Our own sources within certifiers have contrary opinions to TE. For example, they say they do not have the information from what TE calls “volume monitoring throughout the year”.

But this is information which TE suggests it has when it tells us: “Collecting data on the transactions of preferred materials bought and sold throughout the supply chain allows us to pinpoint with greater accuracy when and where there are mistakes or inconsistencies and address their route cause.”

When asked how it reconciles data for market reports, TE notes: “Since organic is governed by national and international standards, without recertifying all the farms to our own organic farming standard, we are not able to ‘verify’ global organic cotton production or what is happening on a farm.

“The organic cotton data that we collect through our various programmes have allowed us to identify weak links and inconsistencies in the supply chain. Solutions that are more straightforward (i.e., additional audits, additional data requisition for checking etc.) have already been put in place. Others, which are more complex and requires longer implementation timeframe (i.e., revision of standard, Trackit program etc.) is currently in progress.”

Surely though, reconciliation is checking for discrepancies, not recertifying? It means looking at the reports feeding into the market reports, at data in certification systems, checking totals in and out across all systems to see if they balance. Which is what was offered in 2014 with Check Organic.

Hermann claims that inertia defeated his attempts to get the organic cotton sector to try Check Organic back then.

Wryly, he adds: “I still believe Check Organic and GOTS would have been a perfect fit ... would have prevented the fraud as supply chains and quantities would have been known based on production data and yield.”

We asked both GOTS and TE how they checked integrity.

“GOTS has a multilevel system in place to make sure only truly organic fibres enter the GOTS supply chain. Before GOTS Certification Bodies (CBs) issue a Transaction Certificate (TC), GOTS requires that a thorough assessment takes place,” Stripf told us. This includes checking on certifiers’ websites and with India’s Tracenet and “authenticity checks of transaction and scope certificates”.

TE said: “Our goal is to collect comprehensive volume data of certified material in our system. This will require centralisation and aggregation of transaction certificate data, which is currently in implementation with our TrackIt program.

“To achieve this, we will also need to collaborate with other organic certifications, such as GOTS. This data could then be compared with our farm-level reporting to provide more comprehensive picture of material being produced and sold as organic.

This is progress, although using systems like Check Organic earlier might have limited problems. It also makes the case for an open-source database.

TE said it aims to reconcile three data sources in the coming year: organic cotton production, organic cotton processing in the supply chain and organic cotton uptake by brands.

Open data and mass balance

Transaction certificates are supposedly the keys to the integrity process, but no one knows how many there are, or what volume of cotton and textiles they report. They can and have been falsified.

In articles back as far as 2015, Ecotextile News reported that String 3.0 and Check Organic could analyse external databases allowing some reconciliation of balances in and out of the organic cotton system.

It’s astonishing to some that so many potential tools for reducing or eliminating organic cotton fraud have never actually been tried.

Solutions?

Is part of the problem that large, industry and big brand dominated organisations think everything must be in their image: big, centralised, western-based and financially expensive? Meaning that small, nimble players and those in India, for example, cannot be ‘trusted’ to fix the problems?

But in the wake of the New York Times expose, it’s clear that change is needed fast. It’s time for organisations to admit they've dropped the ball, and start to open up and become transparent rather than close ranks.

What’s needed soon is for organisations to release their data and make it publicly available, and open source, in a repository where it can be scrutinised and checked by independent analysts so that even the smallest players can check it for themselves.

Argento suggests that the Sourcery's Direct-to-Grower approach is one of a handful of solutions that helps brands and suppliers connect to farmers.

“Once a brand or supplier connects with farmers, they soon realise they cannot rely solely on certifications, but must invest in farmers and their communities if they want to source cotton that was actually grown organically,” he says.

Ambatipudi adds: “Yes, it’s time for some serious introspection for the sector as a whole and radical changes in behaviour... Again, at the expense of sounding repetitive, the way forward for the sector is to build a direct connection and relationship between the brand and the farmer!”

Anita Chester, of the Laudes Foundation, is optimistic: “Many improvements can be made to the certification system ... through greater transparency, collaboration between standard owners in data sharing and co-ordination with state agencies.

“However, the issue is deeper than certification only. It requires a systemic approach to eradicate bottlenecks and bolster the production of sustainable cotton by making it more attractive for farmers.”

The OCA's Vollaard offers: “We have the ability to put in place various measures at the origin point of the organic cotton, to mitigate risks such as fraud and GMO presence. And that’s not just through measures of control and testing, but just as much, or even more so, through investing in the right support and prevention measures at the farm base.”

Back in February, a TE statement claimed that new measures were underway. They later told us that the ‘minimal viable product’ of the organisation’s new digital Trackit programme was completed in November 2021.

“The system is built, and we are now actively onboarding all 25 of our certification bodies into the system. Onboarding 25 certification bodies takes time as they too must redevelop their systems, harmonise their data before they can integrate with our system. We plan to complete this within 2022 and will offer it as a single source of truth for our certification data,” said TE.

This is good – but we remain cautious due to previous announcements and would welcome seeing other organisations involved as well as an open model for data sharing.

Control Union believes the sector needs a different conversation. There should be no more paper, and product movements should be tracked. Robert Demianew and Binay Kumar Choudhury say there is “need for a level of transparency, to iron out hotspots” – essentially open data again, with different systems connecting and digital internal control systems.

Stripf added that GOTS' improvement plans included adding quality assurance staff, as well as a working group with accredited CBs “to define a common approach to risk assessment” and a centralised database to track all materials in their chain of custody.

This is also close to an electronic internal control system. And lo and behold, such systems already exist. For example, Check Organic's, and that of Source Trace, an Indian traceability provider.

Promoters and standards setters can't be police

We need to be warily optimistic. If organisations have refused applications because developing their own offered more control and/or profit and/or centralisation, this is the wrong way to go. Monopolies are viewed as a bad thing for good reason.

Promoters can't and shouldn't police any sector due to conflicts of interest. They should however fund the solution – as should brands. They are the ones who benefit the most.

An open-source system is needed. Transparency and traceability are a big part of the solution. So is improving farmer incomes and livelihoods.

Vollaard says: “The change we want to see requires a collective effort where all actors take their responsibility, from brands and suppliers to standards and governments.”

He adds that the most recent scandal around fraud is an opportunity: “These recent discussions in regard to doubts on certification in the industry give a voice to the change-makers and puts a spotlight on the need for behavioural change,” he says.

Most people agree that more cooperation is necessary. Stripf says “only a common approach by all stakeholders in organic cotton production will solve the problem”.

But he insists that the system works because “we detected fraud and imposed a Certification Ban on 11 companies (affecting 20,000 tons of cotton, one sixth of India's total production) operating in India”. And because GOTS is developing a central database.

TE agrees: “Fraud is a complex issue that will take all of us working together to solve the problem.”

Technical solutions

Balaji A., a development manager at India-based Source Trace, which develops agri value chain management software, says the problems of fraud require physical checks on processes, but “we make tampering difficult by collecting data at every stage as well as processing the agent’s name and ID etc. so that the personnel is wary of tampering”.

Source Trace's system is based on a farmer group, each farmer having a unique ID. It captures “farm and farmer details, general ICS information” and uses a digital linked weighing scale to add data on quantity of cotton received, including date and time. Payments to farmers’ bank accounts are captured. Geolocation is used to track shipments and movements with unbroken traceability.

Balaji A. tells us it has enhanced transparency for Chetna and enabled “real-time data collection and accurate information that helps the company to monitor the production of organic cotton in an efficient manner”. He concludes: “Monitoring and evaluating improvements in social and environmental practices throughout the sustainable agriculture value chain becomes possible.”

What next?

Can progress be made? Vollaard says: “I am optimistic because I have seen what we can achieve when all actors in the chain actively engage and take responsibility.” He says the OCA is now working with nearly 80,000 farmers “close to one-third of the organic cotton farmers of India”.

But this does require opening the black boxes – for everyone to open their databases and knowledge and share. Time perhaps also for newer organisations to take the lead?

If steps are not taken now to open access to raw data, consider alternative solutions for supply chain traceability and to accept far greater industry collaboration between all stakeholders in the organic sector, then this thread will be stretched beyond breaking point, and we’ll see any remaining market confidence in organic cotton start to unravel.

And at the end of the day, it will be the impoverished farmers and their communities on the ground in developing regions that will suffer the most if this happens.

To avoid this, the organic cotton sector now needs to press the pause button, rewind and reconsider, then fast forward to a more inclusive – rather than exclusive – way of working.

Right now, it’s clear that the credibility of organic cotton in India – and by association everywhere else – is literally hanging by a thread.